Is the Future Hegemony of the Dollar Under Threat?

World trends in trade are swerving towards abandoning the greenback in favour of national currencies

Written by Samuele Viscariello

The US dollar has been the world’s reserve currency since the end of WWII. Countries’ central banks and financial institutions hold dollars to hedge against exchange rate risks, honour international debt obligations, pay for commodities, and as a saving mechanism. The dollar is backed by the strongest economy in the world and by the safest and most liquid security of all, US Treasury bills. This dynamic puts the US in a politically and financially advantageous position, but will the bald eagle ever be tamed?

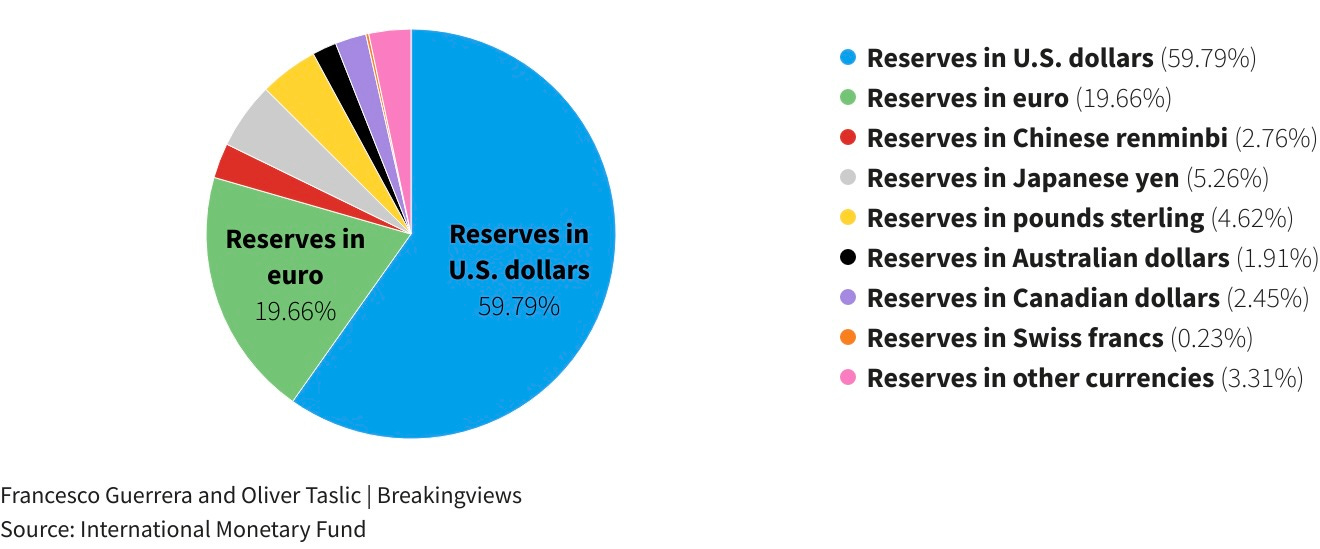

BRICS countries (Brazil, Russia, India, China, South Africa) have started to trade among themselves with their domestic currencies, while many African countries are working to come up with regional currencies which would make intra-continental trade cheaper and easier. The Dollar share of global foreign exchange reserves is at 59%, its lowest level in the last 25 years. Some experts, including U.S. Treasury Secretary Janet Yellen, claim that the severe sanctions imposed on Russia may jeopardize the greenback’s hegemony. Others dismiss this theory, claiming that until the US will retain economic dominance there is nothing to fear.

Costs and Benefits of Dollar Hegemony

Since the dollar became the world’s reserve currency in 1944 with the Bretton Woods agreement (some argue it already earned hegemonic status in the 20s), the US has been able to shape global financial and geopolitical policy. This position allows the US to raise debt cheaply to fund government programs and industrial policy. Deficits are more easily sustainable and don’t expose the country to significant financial instability. Investors are attracted by the liquidity and safety of bond and equity markets, while also using the dollar as a saving tool. Moreover, most commodities are traded internationally in dollars. As banks hold accounts with the Federal Reserve to carry out trade transactions, the US government can sanction countries financially, even when these are not trading partners. It derives a massive American seigniorage, as the US benefits economically from transactions in which it is not involved while steering the geopolitical agenda.

The advantages can often be offset by serious financial repercussions. According to some economists, the dollar dominance may have been one of the triggering factors of the Global Financial Crisis. Exporting countries with weighty trade surpluses used dollar denominated securities to increase their foreign reserves holdings. With demand for the currency increasing, the financial sector was nudged into supplying riskier securities, which ultimately caused the whole system to collapse.

Machinations for an alternative currency union date back to 2014 when sanctions were imposed on Russia due to the invasion of Crimea. This prompted BRICS countries to enter discussions over using a common trading currency to distance themselves from the US dollar. As unfeasible of an idea this is, it signalled a strong willingness to depart from the financial status quo. After the more recent sanctions on Russia, the Kremlin has decided to completely lose the dollar in Russia-China transactions, which are now carried out in rouble and yuan.

The Direction the Rest of the World is Taking

The list of countries walking the same path as Russia is extensive. Last April, Brazil, the biggest economy in South America, and China abandoned the dollar in favour of the yuan. In January, the South American giant was working to design a common currency with Argentina, yet with Milei’s election this is not going to happen anytime soon. Earlier this year, Kenya agreed to buy Gulf companies’ oil in domestic currency, the shilling. Regional trading blocks in Africa such as the EAC (East African Community) and SADC (Southern African Development Community) are looking into the possibility of creating a common currency, while the AfCFTA (African Continental Free Trade Area) is calling members to trade in domestic currencies. Algeria, Africa’s largest exporter of natural gas, is expected to join the BRICS alliance, showing interest in detaching the country’s trade from the greenback. Iran, who is also looking to join BRICS, is in talks with many African countries to depart from the use of dollars or euros in their trading relationship. ASEAN countries, US’ fourth-largest trading partner, have agreed to ditch the dollar and are developing a regional payment system allowing them to trade in local currencies. The Indian rupee is gaining popularity as well, with the Reserve Bank of India inviting the central banks of several countries (e.g., Tanzania, Uganda, Kenya) to open Vostro Rupee Accounts.

A new hegemon or a multipolar world?

As much as the dollar amount of global foreign exchange reserves has hit a 25-year low, it is still in the overwhelming majority.

Investors are rewarding countries such as Egypt and the Ivory Coast, with the former on track to meet the IMF targets and the latter able to secure an IMF loan and hedge against exchange rate fluctuations thanks to its currency being pegged to the Euro. Yet, many countries, especially in the African continent, are struggling to amass dollars to repay their debts. Inflation and higher rates have greatly devalued their currencies. Their dependence on the IMF is an indirect dependence on the US, given the veto power the United States have in the fund. If de-dollarization projects in other regions are successful, these countries and blocks will see and grab a feasible opportunity to depart from the current regime, seeking trade in national and/or regional currencies. Although still being the biggest share in FX reserves, the dollar will eventually share the stage with other various currency and its geopolitical pull will diminish, as it will not be able to sanction transactions as freely as it does now. US Treasury bills will most likely be the safest investment and the cost of US debt will be the lowest, but investors will have a bigger chance to diversify.

The momentum for de-dollarization is growing, and with the BRICS alliance expanding, the trend will crystallize further. The US may have over-exploited its hegemonic powers, pushing countries to resort to other solutions. While neither the Euro nor yuan are likely to take over, the world will become less dependent on the dollar and more reliant on bilateral and regional currency agreements. Banks will need to hold a more diversified FX reserves portfolio. The world may soon take a different spin that does not revolve around the United States.

🤞🏾